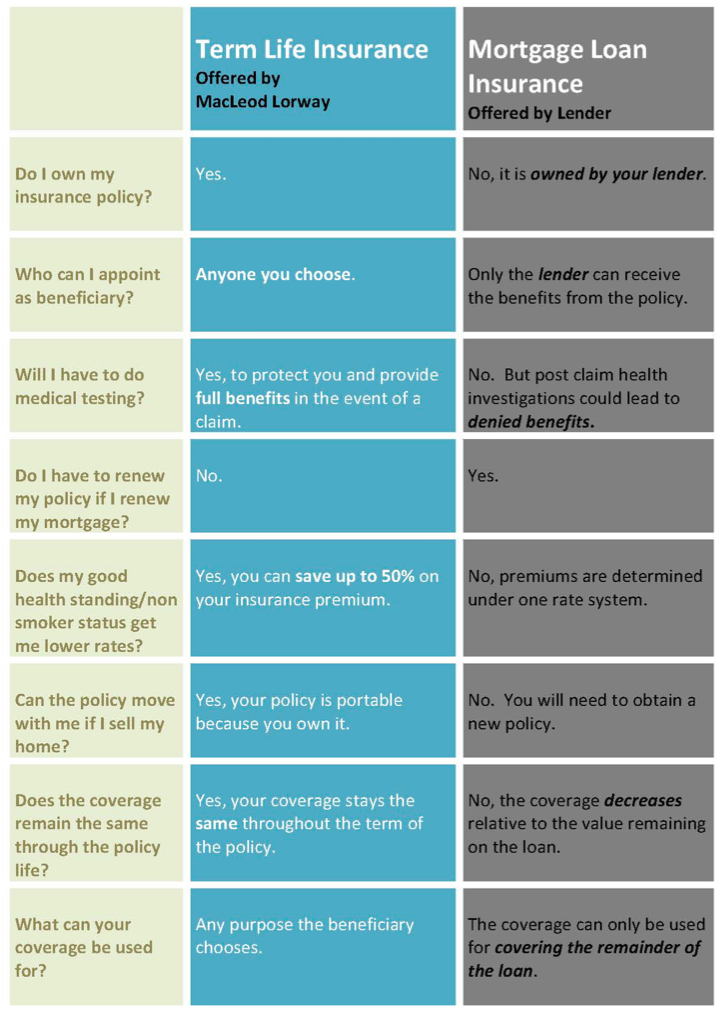

Owning a home is one of the biggest assets for most families, so making sure that investment is protected is critical. Insurance is the obvious answer for protection, but what is less obvious is whether you should buy mortgage insurance on the mortgage itself or use a term life insurance policy instead. The key difference between the two is who owns the policy. In the case of mortgage insurance, the lender owns it and is the sole beneficiary. In the case of life insurance, you own your policy and can determine who is the beneficiary and how the coverage can be used.

To find out what’s right for you, contact Jamie Clarke or Lisa DellaValle to discuss your needs.